Withholding calculator

This Federal Income Tax Withholding Calculator is intended to be used as a tool to estimate your own monthly federal income tax withholding. Find tax withholding information for employees employers and foreign persons.

Use This Sales Tax Calculator To Figure Sales Tax Or Vat Gst At A Rate Of 8 25 Free To Download And Print Tax Printables Sales Tax Tax

Personal income tax rates and tables.

. The Tax withheld for individuals calculator is for payments made to employees and other workers including working holiday makers. Use the buttons at the bottom of each page to navigate through the calculator. If you do not have access to the Tax Withholding Estimator but wish to have roughly accurate withholding and retain privacy you may use.

The unitary combined reporting deadline has passed. PaycheckCity calculates all taxes including federal state and local tax for each employee. Use this calculator to estimate the amount of money that would be withheld from your monthly pension payments for federal income tax based on the IRS current tax tables and various tax filing options.

Corporations subject to Virginia income tax may need to file a one-time report with Virginia Tax by July 1 2021. You should decrease your withholding if. For employers and employees - Use the calculator to determine the correct withholding amount for wage garnishments.

Please ensure that the information used in the calculation is. It is important that your tax withholding match your tax liability. This is an online version of the PVW worksheet.

Cases for 25000 or Less. Free Federal and Illinois Paycheck Withholding Calculator. It will take between 2 and 10 minutes to use.

S45 Withholding Tax Rate Late Payment Penalty Calculator. Personal income tax audits. To use the calculator youll need certain pieces of documentation.

In order to print a tax withholding election form to submit to ETF click the Print Tax Withholding Election Form button. To change your tax withholding amount. For more information see our Unitary Combined Report Reference Guide.

If you work for more than one employer at the same time you must not claim any exemptions with employers other than your principal employer. Our withholding calculator doesnt ask you to provide personal information such as your name Social Security Number a ddress or bank account information. Guide to Using the Withholding Calculator.

Use this calculator to determine the Total Number of Allowances to enter on your Massachusetts Tax Information in Employee Self-Service. Your withholding is instantly calculated for you. For a start the calculator will ask for an estimate of your income and your eligibility for the Earned Income Tax Credit and the Child Tax Credit.

You rest assured knowing that all tax calculations are accurate and up to date. This calculator can be used to determine how much you would like to withhold from your benefit payment for taxes. Choose the right calculator.

Collection of Credit Card Debt. You dont need to do anything at this time. Your tax liability is the amount of money that you owe to the government in federal taxes taking into account any tax credits for dependents mortgages or charity.

You are presented with an amount that you owe in taxes from the output of our W-4 calculator and your desired tax refund amount is 0. Penalties and interest for personal income tax. Carefully read all information and click the blue Withholding Calculator button.

Enter your withholding code from Form CT-W4P Line 1 and your monthly pension or annuity amount before any reductionsPress the Calculate Your Withholding button. Required Field. Wage Garnishment Earnings Withholding for Employers.

The withholding calculator can help you figure the right amount of withholdings. The buttons allow users to continue inputting their information reset the information on that page or start over from the. Cases for Over 25000.

If you prefer to capture the entire page refer to the instruction on myTax Portal Technical FAQ. The Form W4 Withholding wizard takes you through each step of completing the Form W4. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate.

If pay for any of the jobs changes significantly you will need to use the Tax Withholding Estimator again and furnish a new Form W-4 to change the amount in Step 4c to have accurate withholding. Submit or give Form W-4 to your employer. Ask your employer if they use an automated system to submit Form W-4.

This calculator is intended to be used as a tool to calculate your monthly Connecticut income tax withholding. Oregon personal income tax withholding and calculator. 2022 rates will be effective Feb 1 2022.

You can use this calculator to compute the amount of tax due but this system does not allow you to file or pay the amount online. If your spouse is not working or if she or he is. IRS tax forms.

There are 3 withholding calculators you can use depending on your situation. Safari on iPhoneiPad iOS 9 and above Take a screenshot of your iPhones iPads screen for your reference. Once you have submitted the information this system will generate a PVW Worksheet.

Go to the main Withholding Calculator page on IRSgov. Instead you fill out Steps 2 3 and 4 Help for Sections 2 -- Extra Withholding because of Multiple Jobs If your household has only one job then just click Exit. Cases for 10000 or Less.

Tax withheld for individuals calculator. You should increase your withholding if. Other Oregon deductions and modifications.

2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line. Previous rates Personal income tax underpayment and overpayment corporation underpayment and estimate penalty rate. You are presented with a tax refund amount from the output of our W-4 calculator and and your desired tax refund is 0.

Estimated Maryland and Local Tax Calculator - Tax Year 2022. Earnings Withholding Calculator for Employers. Based on the Withholding Limitations Worksheet PDF the Income Withholding Calculator is an interactive form designed to calculate withholding in accordance with federal and New York State law and regulationsThe calculator is meant as an additional tool to help employers calculate child support withholding.

The Form W4 provides your employer with the details on how much federal and in some cases state and local tax should be withheld from your paycheck. It only takes a few minutes to do however. For employees withholding is the amount of federal income tax withheld from your paycheck.

If your withholding doesnt take these into account you could be having too much. Once you input all the information for your situation youll receive details about your results and instructions on how to update your state income tax withholding using the new Oregon. Indicates that a field is required.

The amount of income tax your employer withholds from your regular pay depends on two things. Topics Problems With Money. To keep your same tax withholding amount.

You will need a copy of all garnishments issued for each employee. What PaycheckCity Does What You Do.

Estimate Your Paycheck Withholdings With Turbotax S Free W 4 Withholding Calculator Simply Enter Your Tax Information And Adjust Y Turbotax Tax Refund Payroll

5 6 Sales Tax Calculator Template Sales Tax Calculator Tax

The Calculator Helps You Identify Your Tax Withholding To Make Sure You Have The Right Amount Of Tax Withheld From Your Paycheck At W Tax Time Paycheck Checkup

Tax Calculator Calculator Design Calculator Web Design

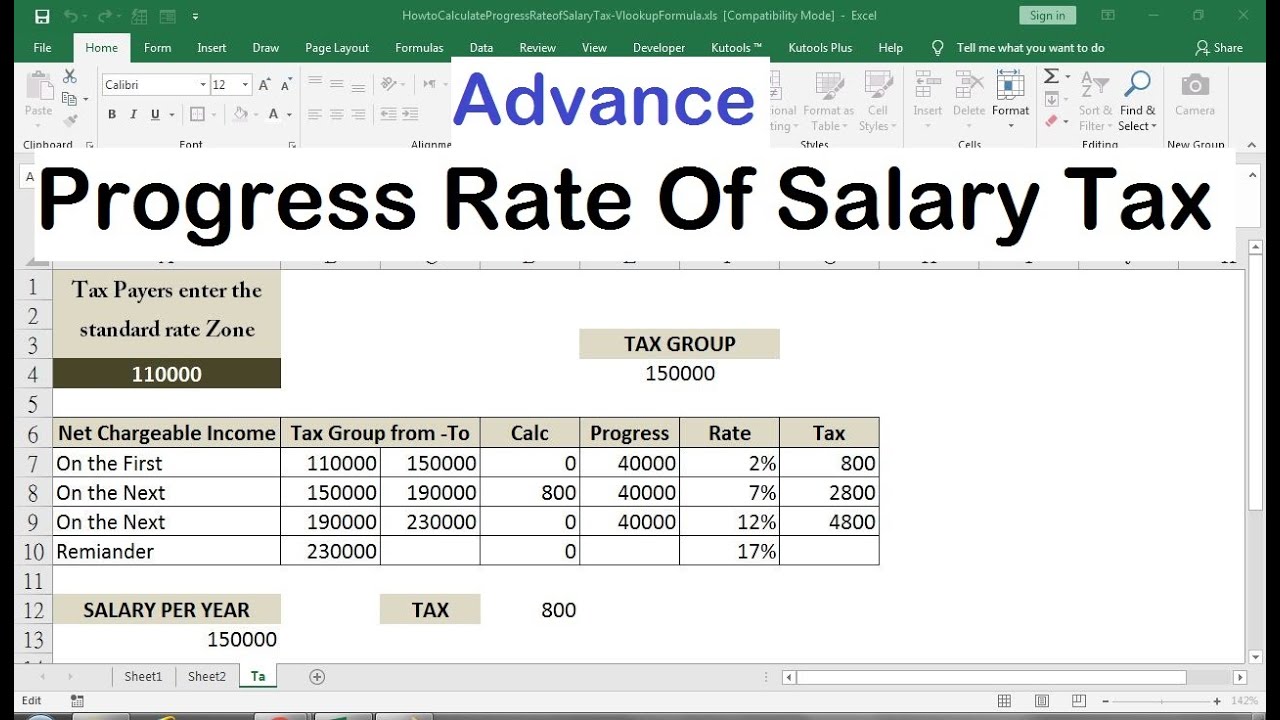

Pin On Raj Excel

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Self Employed Tax Calculator Business Tax Self Employment Employment

Tax Withholding Calculator For Employers Online Taxes Irs Taxes Federal Income Tax

Tax Calculator Excel Spreadsheet Excel Spreadsheets Spreadsheet Excel

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

2020 Income Tax Withholding Tables Changes Examples Income Tax Income Federal Income Tax

Payroll Time Conversion Chart Payroll Calculator Conversion Chart

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp Payroll Payroll Software Savings Calculator

Tax Calculator Calculator Design Financial Problems Calculator